2023 Monterey Car Week Auctions

The Monterey Car Week auctions concluded Saturday with the second highest total in history. The 1,200+ vehicles, including 150+ $1 million vehicles offered across five auctions resulted in total sales of $400.1 million and a sell-through rate of 68 percent. That falls short of 2022’s total of 1,000+ cars which sold for nearly $473 million at a sell-through rate of 78 percent. We’ve observed a cooling market for the past 15 months, and in Monterey we finally witnessed that trend touch the highest echelons of the collector car world.

The cooling market we’ve observed for the past 15 months reached the Monterey auctions after having little impact last year. Hagerty Automotive Intelligence is hearing of several factors stemming from the first season of Monterey auctions in a higher interest rate environment, namely, an increased discipline at the higher end of the market, weakening demand from new collectors and higher prices that have given pause to buyers at the upper end of the market.

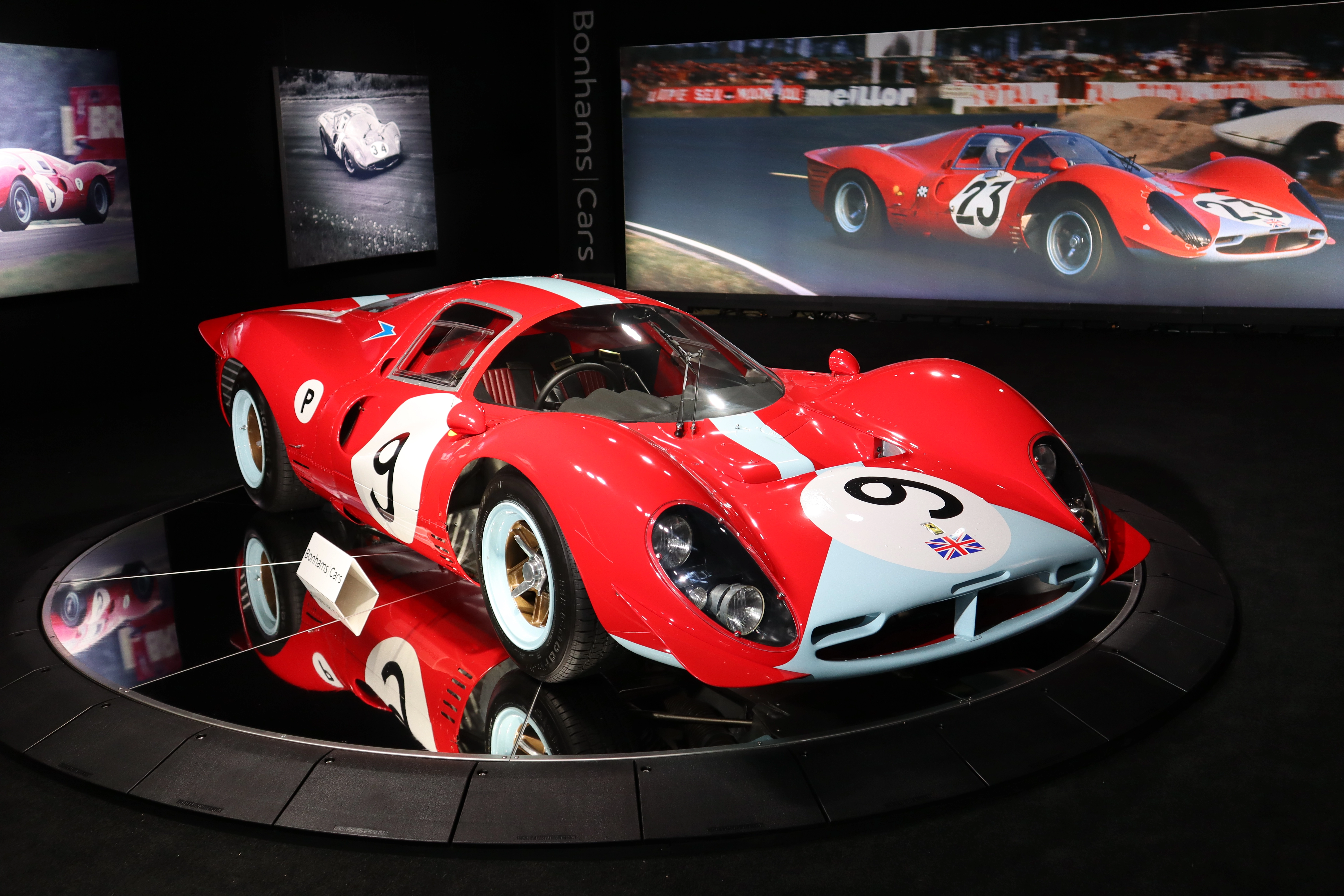

Even Ferrari prototype race cars from the 1960s appeared to be impacted. The star of the week, a 1967 Ferrari 412P at Bonhams, sold for $30.2 million after a rather subdued showing that left observers wondering why it didn't get more bids. (It was still a strong sale, placing it fifth on the all-time list of publicly auctioned cars, though some estimates placed the car at as much as $40M.) The following day, RM Sotheby’s offered a 1964 Ferrari 250 LM which didn’t sell on a high bid of $17 million. The sense of restraint could be felt across segments, as other blue-chip models fell short as well, including a 1960 Porsche RS60 bid to $4.8M and a 1914 Simplex 50hp that stalled out at $1.1M.

In contrast, rare marques and models—especially those in good condition with interesting provenance and event eligibility—sold well. A 1909 Lorraine-Dietrich Grand Prix car with a 16.4-liter 4-cylinder engine traded for $1,270,000 at Bonhams, well above the high estimate of $800K. Gooding & Company sold a 1914 Mercer Type 35-J Raceabout for a record $4.8M. RM Sotheby’s sold a 1959 Frisky Convertible Special for a record $84,000 and a Lancia Hyena Zagato for $246,400. Broad Arrow sold a 1937 Terraplane Series 72 Super Convertible Brougham for $117,600, which was a record for the marque. In today’s climate, vehicles that really stand out command attention—and a premium.

Despite a record price of $632,000 for a Honda NSX-R, auction goers at Monterey haven’t quite figured out the market for JDM (Japanese Domestic Market) vehicles. Two Subaru Impreza 22Bs were offered, including the first prototype of the model, which failed to sell after a high bid of $365,000. While 22Bs just became legal for import within the past 2 years and typically garner a lot of attention on online auction sites, they went mostly overlooked here. Similarly, a different venue may have also helped the 1996 Nissan Skyline GT-R R33 ‘Tommykaira’ R. While it sold for $134,400, 24 percent over #1 condition Hagerty Price Guide value for a standard R33 GT-R, we expected it to do better considering the legendary reputation Tommykaira enjoys in the JDM community. A very clean Autozam AZ-1 sold for $22,400, 25 percent below low estimate despite the fact that a different micro-machine, the 1959 Frisky mentioned earlier, sold for more than double its high estimate.

Japanese cars sold in America when new performed much better than their JDM peers. Setting a new record for the model, a 1980 Datsun 280ZX 10th Anniversary with only 28 miles sold for $231,000. A 47-mile 2012 Lexus LFA sold for $1,105,000, making it the first non-Nürburgring edition to break seven figures, and selling well above a 1967 Toyota 2000GT at $940,000, suggesting it is the newest blue-chip Japanese car.

Inconsistency appeared through the sales this week. A 1912 Simplex 50 hp Toy Tonneau with 111 years of single-family ownership sold for $4,075,000 at Gooding, following the $4.85M Simplex sold by Bonhams that took the top sale last January in Arizona. If only bringing a similar example of the marque to auction was that simplex: Bonhams found their 1914 Simplex 50 hp Tourer unsold on Friday with a high bid of $1,100,000.

The median final price premium relative to condition-appropriate Hagerty Price Guide value was 8.6 percent this year, down from 19.7 percent last year. That shrinking premium indicates less enthusiasm from bidders. Similarly, sell-through rates were down across nearly every segment, especially after the strong showing last year. However, beneath that lower sell-through rate is an even lower sell-through rate for $1M+ lots as seen in the included chart below.

Despite auctions in the U.S. returning to a regular tempo for the remainder of the year, we’ll be watching sales at Goodwood and London in the U.K. in September to determine if what we’ve seen in Monterey is truly a shift in momentum. Of course, RM Sotheby’s will feature the 1962 Ferrari 250 GTO serial number 3765 at a one-car auction in New York City in November. It’s important to remember that car week auctions, while large, are just a small part of the bigger picture.

The 10 best sales from all auctions until Thursday: