Arizona Auctions: How Hot Will They Get?

January’s auctions represent a refresh for the enthusiast vehicle market—though this past fall afforded a couple of auction headlines, the last time many people tuned in was back in August for the auctions on the Monterey peninsula. This year, the auctions in Arizona and Kissimmee—which together sell more cars at live auction in one month than at any other time of the year—are faced with a declining market that shows signs of being more cautious (and rational) than in years past. We’ve crunched some numbers to forecast how these sales may unfold. Let’s take a look.

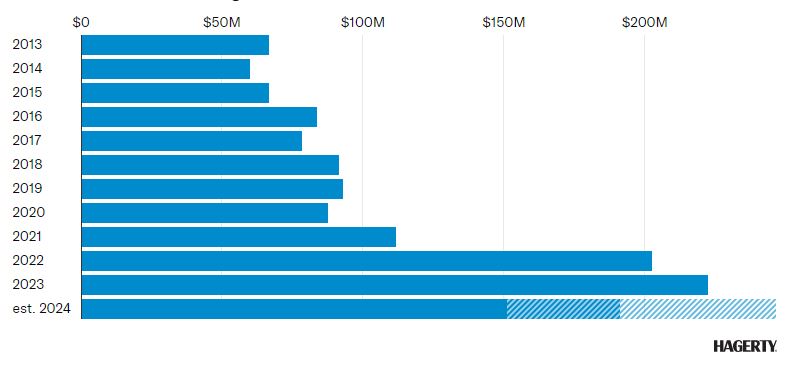

One auction that has changed the picture of the January auctions over the past several years is Mecum’s Kissimmee auction in Florida. A stand-alone event, it has blossomed into a spectacle where more than 3,000 vehicles are sold over nearly two weeks, with total sales exceeding $200 million. From 2019 to 2023, vehicles sold and total sales grew by 47 and 140 percent, respectively. However, we expect the overall decline of the market to slow that growth this year. Perhaps as a sign of that slowdown, comparing the first several days of Kissimmee this year to last, the average sale price is down nearly 14 percent, but post-block sales may shrink that difference.

Mecum's Kissimmee auction total sales – If Mecum's million dollar consignments sell, total sales could exceed $200M

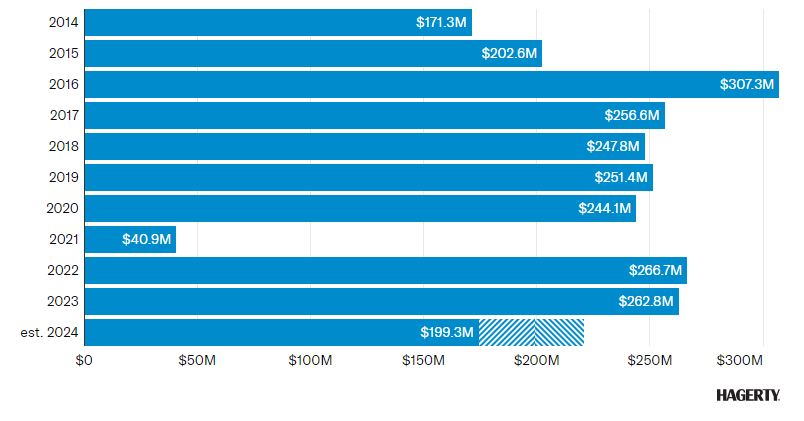

We also expect growth at the Scottsdale auctions to slow. It is worth breaking down why, however, since it’s not merely a result of broader market forces.The companies holding auctions in Scottsdale have changed over the years—some have left, and others have left only to return. Of course, the anchor event run by Barrett-Jackson will be auctioning no-reserve cars for nearly a week. Bonhams and RM Sotheby’s, which are holding auctions on Thursday the 25th, will join them. MAG Auctions will also have a sale that weekend. However, Worldwide Auctioneers will return, while Gooding & Company will be absent again.

Despite this shuffling of the auction companies, the number of cars will be nearly the same at approximately 2,200 vehicles. Though the volume is similar, the cars coming to auction this year suggest that the average price of the 2024 Arizona sales may be down around 15 percent from 2023. While Barrett-Jackson’s auction format produces consistent results, smaller auctions like RM Sotheby’s and Bonhams have more variable sales. Last year, Bonhams had almost 50 more vehicles consigned, and it included one $5 million 1912 Simplex. With fewer cars at Bonhams, and with fewer star cars like the Simplex, along with lower prices seen at auctions in 2023, we expect total sales will be lower by between 16 and 34 percent, or between $175 million and $221 million.

Total Sales in Arizona could exceed $200 million – Although sales could be as high as $221 million or as low as $175 million

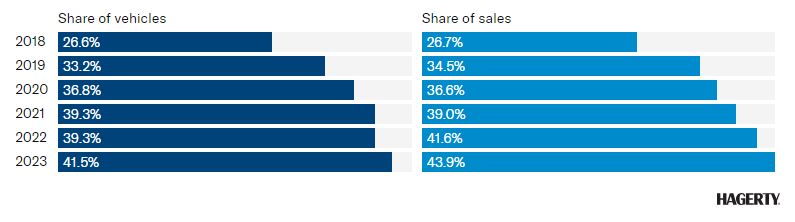

Customs, restomods, and hotrods are a big part of Barrett-Jackson’s Scottsdale auction. Not only are modified vehicles becoming more numerous at the auction, but they’re also becoming more valuable. Modifications used to be a way to turn less desirable vintage rides into something more marketable, but now it is common even for desirable vehicles like the ’63 Corvettes and ’67 Fastback Mustangs to get the restomod treatment. The market is responding by paying more for modified vehicles as their share of total sales grows faster than their share of vehicles consigned.

Custom vehicles at Barrett-Jackson are becoming more valuable – Their share of total sales is now larger than their share of the run list.

Arizona’s auctions will also afford the opportunity to check in on several trends, including recent dips in average sale prices posted by the segments discussed here. Specifically, we’ll be watching to see if pickups recover the three percent needed to equal their January 2022 peak, if SUVs make up some of their 15 percent drop since April 2022, and if muscle cars can rebound from a 5.5 decline since May 2022.