The 2026 January Auctions: By the Numbers

With two of the largest auction events of the year kicking off in January at opposite ends of the Sunbelt, several thousand vehicles cross the block in a matter of weeks. Online auctions have continued to grow, but even their scale doesn’t yet match a week at Barrett-Jackson’s Scottsdale auction nor Mecum’s even larger Kissimmee sale. Bonhams and RM Sotheby’s also held sales in Arizona, and offered some of the higher-value cars. Our expectations for the January auctions this year were tempered by the stable Hagerty Market Rating we saw throughout 2025. However, the story wasn’t about the volume of cars, but about the incredible prices some of the vehicles sold for. See below for the key points from Arizona (Barrett-Jackson, Bonhams, and RM Sotheby’s) and Kissimmee (Mecum), for the full results from each sale, and for a few interesting trends:

- Total sales: $678M, up from $446M in 2025

- Average sale price up 71% to $144,161

- Supercars dominated the headlines at all the auctions

- 1960s collectibles mostly sold at condition- and provenance-appropriate amounts

Despite approximately 500 fewer vehicles offered at the auctions, a nearly 8% drop, and a sell-through rate that fell from 83% to 80%, the much higher average price accounted for the increase in total sales.

Supercars stole the show at all the auctions. Mecum’s Bachman collection, which comprised mostly low-mileage and highly personalized Ferraris, set the stage.

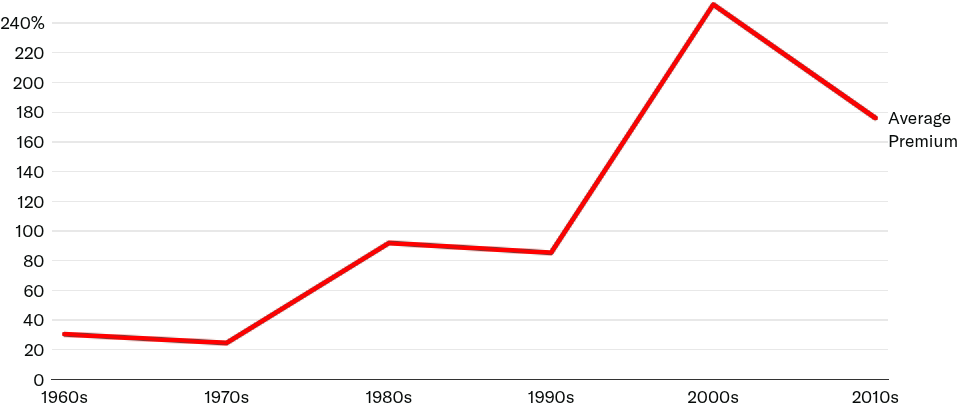

Bachman Collection Ferraris at Mecum's Kissimmee Auction

The average premium paid vs. the condition 1 value for Ferraris of the 2000s was over 240% or 3.4 times more.

Cars of the 1960s in the collection sold on average 31% above their condition #1 (concours, or best in the world) value and those of the 1980s were nearly double (92%), but those of the 2000s were 240% (or more than triple) their respective condition #1 values. Similar supercars at the other January auctions also saw strong bidding.

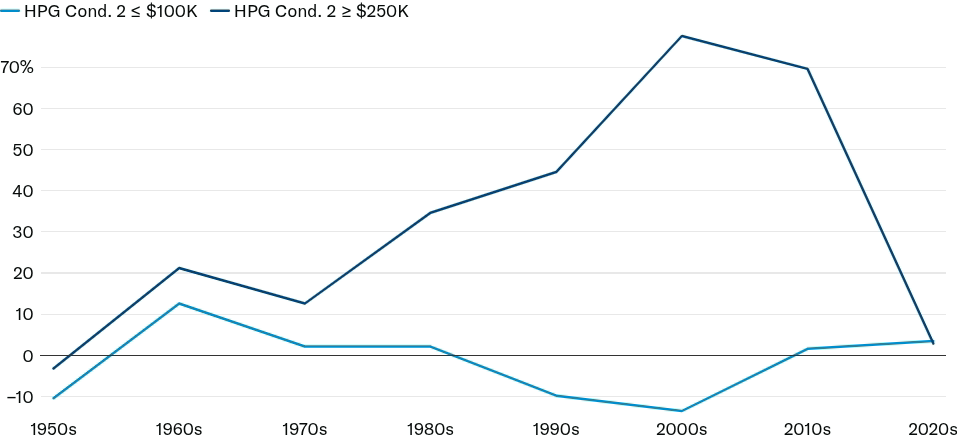

Looking beyond supercars and comparing price levels, of which supercars tend to be in the higher level, reveals the variation in the market. Vehicles with a condition #2 (excellent) value of $250K or greater showed a similar pattern, with a growing premium above the condition #2 value for vehicles from the 1970s through the 2000s peak. Conversely, if the condition #2 value was $100K or below, only 1960s vehicles saw much bidding above that value, with a 13% average premium. Car enthusiasts have probably heard of Chrysler’s K-cars, or the Kei cars of Japan, but we may have to become familiar with the K-shaped economy.

Market performance of 1980s-2010s vehicles varied by price level

A 2000s era vehicle with a condition #2 value of $250K or more saw an average sale price 78% above that value vs. a 14% discount if that value

was $100K or less.

With upcoming auctions in France and Florida favoring more valuable vehicles, we expect to see continued strong bidding. But we will also be watching for regional variations.

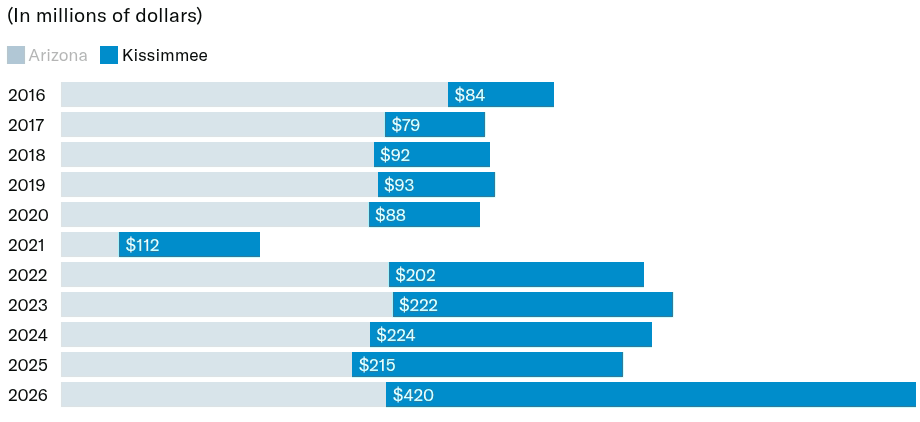

January Live Auction Totals 2016-2026

2024 and earlier include all auctions in Kissimmee and Arizona.

2025 excludes MAG auction.

Only vehicles are counted

2026 Cumulative Results

- Cumulative Total: $677.8M

- Lots sold: 4,702/5,869 (80% sell-through rate)

- Average Sale Price: $144,161

2025 Cumulative Results

- Cumulative Total: $466.3M

- Lots sold: 5,459/6,433 (83% sell-through rate)

- Average Sale Price: $93,037

Overall Top 10 Sales from all January 2026 auctions:

Results broken down by Auction Company

Mecum Auctions

Mecum Auctions – 1962 Ferrari 250 GTO Bianco Speciale

- Cumulative Total: $420.3M

- Lots sold: 2,696/3,849 (70% sell-through rate)

- Average Sale Price: $155,895

Overall Top 10 Sales

2025 Cumulative Results

- Cumulative Total: $217.8M

- Lots sold: 3,224/4,281 (75% sell-through rate)

- Average Sale Price: $67,568

Barrett-Jackson

Barrett-Jackson – Lot 1377

- Cumulative Total: $189.1M

- Lots sold: 1,874/1,874 (100% sell-through rate)

- Average Sale Price: $100,915

Overall Top 10 Sales

2025 Cumulative Results

- Cumulative Total: $191.7M

- Lots sold: 1,944/1,944 (100% sell-through rate)

- Average Sale Price: $98,594

RM Sotheby’s

RM Sotheby’s – 2003 Ferrari Enzo

- Cumulative Total: $57.5M

- Lots sold: 82/90 (91% sell-through rate)

- Average Sale Price: $700,754

Overall Top 10 Sales

2025 Cumulative Results

- Cumulative Total: $31.4M

- Lots sold: 84/90 (93% sell-through rate)

- Average Sale Price: $373,676

Bonhams

Bonhams – Tupac Hummer H1

- Cumulative Total: $11.0M

- Lots sold: 50/56 (89% sell-through rate)

- Average Sale Price: $219,556

Overall Top 10 Sales

2025 Cumulative Results

- Cumulative Total: $5.5M

- Lots sold: 52/77 (68% sell-through rate)

- Average Sale Price: $104,842